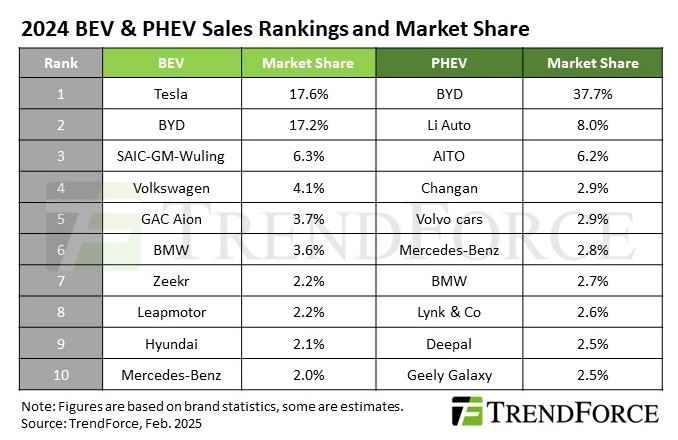

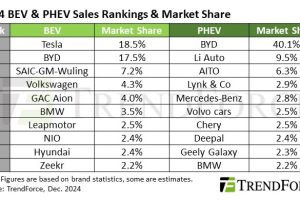

Tesla retained its top position in BEV (battery EV) sales in 2024, with BYD closely following in second place. SAIC-GM-Wuling saw an impressive 44% YoY growth, reclaiming its spot as the third-largest BEV manufacturer.

Volkswagen and GAC Aion ranked fourth and fifth respectively with both experiencing falling sales.

Meanwhile, ZEEKR and Leapmotor nearly doubled their annual sales, making their debut in the global top 10 BEV rankings. Hyundai slipped to ninth place—suffering a 21% sales decline—with lacklustre performance across key markets, including the US, South Korea, and Europe.

BYD dominated the PHEV (hybrid) segment, securing a 38% market share, which exceeded 40% when including its other sub-brands. Li Auto, AITO, and Changan (including Qiyuan) followed in second to fourth place, respectively. Notably, AITO’s strong performance, driven by the success of the M9 model, propelled it into the top 10 PHEV rankings.

BMW’s PHEV sales dipped slightly by 3%, placing it seventh, while the sales gap between BMW’s BEV and PHEV models continued to widen. Additionally, Geely Group saw Lynk & Co and Galaxy enter the top 10 at eighth and tenth place, respectively. In 2024, Geely integrated its brands by merging Geome into Galaxy and Lynk & Co with ZEEKR, forming ZEEKR Technology Group while retaining both brands.

TrendForce projects that global NEV sales will reach 19.2 million units in 2025. China is expected to sustain growth, benefiting from the extension of its vehicle trade-in subsidy policy. However, Chinese automakers face three key challenges: intensifying domestic competition, high investment demands for overseas expansion, and increasing technological rivalry.

Consequently, once fragmented multi-brand strategies are now undergoing restructuring, and industry consolidation is expected to continue in 2025, with a growing likelihood of mergers among major automotive groups.

The US EV market remains highly uncertain. TrendForce warns that if President Trump successfully overturns the $7,500 EV tax credit with congressional approval, the 2025 global EV sales growth rate could decline from 18% to 16%. However, the actual impact will depend on several factors, including the timing of policy implementation, state-level incentives, and automakers’ strategic response to the EV market shift.

What’s an NEV? A ‘New Energy Vehicle’ (Chinese term) or a ‘Neighborhood Electric Vehicle’?

That’s right Tim it’s new energy vehicle – includes fuel cells., battery and hybrid.

Got it, cheers.

I like the “0 to 1939 in 3 seconds. Tesla the Swasticar” adverts appearing on random bus shelters across the country.

It will be interesting to see the figures in a years time.

Googling about the falling Tesla sales and share price there are loads of people asking what they should buy instead of a Musk mobile. Hyundai got mentioned quite a few times. Months ago in a Toyota BZ4X forum someone said that their main reason for buying one was that they didn’t like “the Musky smell of Tesla”.

On a forum not even related to cars I noticed today that a regular poster has changed their avatar to “Boycott Tesla”. Elon is beginning to make Gerald Ratner seem like a marketing genius.