Geost’s payload systems enable space vehicles to detect, interpret, and respond to situational changes in real time.

The headline value of the deal is $275 million. This involves a mix of $125 million of cash and $150 million in shares of Rocket Lab common stock. Plus up to $50 million in potential additional cash earnout payments tied to undisclosed revenue targets.

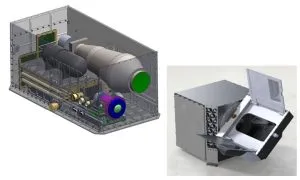

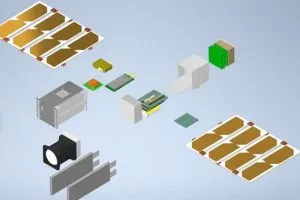

Infrared payloads

Rocket Lab highlighted the deal will increase the range of its services.

“Rocket Lab was founded to disrupt the traditional space industry and we’re doing just that by expanding our ability to deliver complete, mission-critical space solutions. With the acquisition of Geost, we’re bringing advanced electro-optical and infrared payloads in-house to support secure, responsive, and cost-effective systems at scale,” said Rocket Lab founder and CEO, Sir Peter Beck.

“These technologies enable spacecraft that can detect, interpret, and respond to threats in real time, enhancing our role as a trusted provider of end-to-end space capabilities for the United States and its allies – with greater speed, intelligence, and operational control.”

Geost

Geost is portfolio company of ATL Partners, aerospace investment specialists. Bill Gattle, the company’s General Manager commented:

“Integrating Geost’s advanced optical capabilities is a natural next step for Rocket Lab as [it] expands its end-to-end space systems.”

“By bringing high-performance optical technologies in-house, Rocket Lab is strengthening its ability to deliver responsive, full-stack solutions for government and commercial missions.”

Rocket Lab

Rocket Lab uses two main types of rockets. Its Electron is for smaller orbital launch vehicles and Neutron is for medium-lift launches.

The company’s headquarters are in Long Beach, California. It is originally a New Zealand company. Geost is based in Tucson, Arizona.

Image: Geost

See also: Rocket Lab wins $14m satellite separation contracts

Electronics Weekly

Electronics Weekly