SemiAccurate reported that a couple of months ago it saw an email saying that a potential buyer for the whole operation with enough money to pay for it was interested in acquiring the company as a whole.

Last week, SemiAccurate said that further sources have convinced it there is a 90% chance of the story being true.

Speculation about possible buyers includes: Elon, Apple, Nvidia, Softbank, Broadcom and the private equity funds Apollo and Brookfield.

Speculation about possible buyers includes: Elon, Apple, Nvidia, Softbank, Broadcom and the private equity funds Apollo and Brookfield.

It is being said that Qualcomm and Globalfoundries are joining Musk in the rumoured bid. Anecdotal reports include that Elon, GloFo and Qualcomn were at Mar-a-Lago over the weekend.

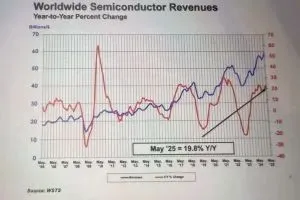

There are indications that investors are getting fed up with supporting Intel’s attempt to catch up in process technology which has seen the shares drop from 60 to 20 in the last three years.

Currently with a market cap of around $100 billion, Intel has debt of $50 billion, cash of $24 billion, annual cash flow of $9.7 billion (down from $36 billion in 2020) and an annual capex requirement of around $30 billion to become, and remain, competitive.

Electronics Weekly

Electronics Weekly