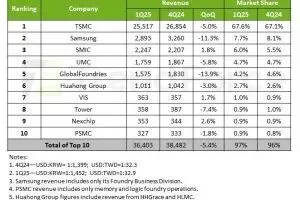

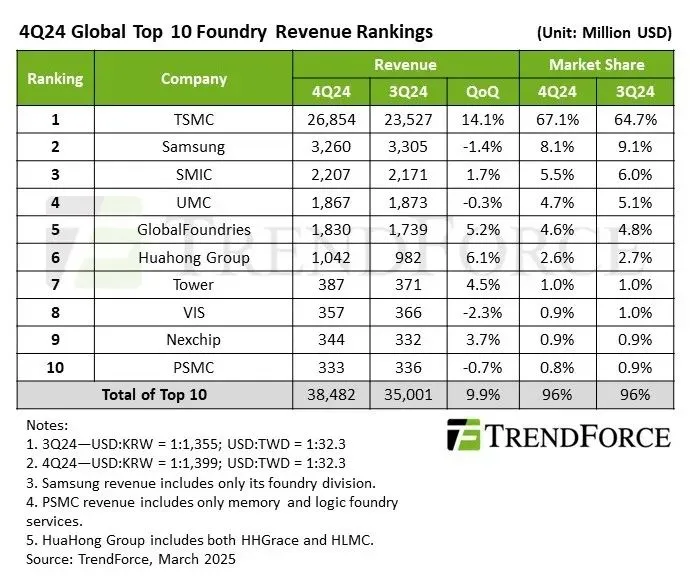

However, mature nodes saw a slowdown in growth .

TSMC boosted revenue to $26.85 billion for a 67% market share.

Samsung Foundry ranked second, with revenue declining 1.4% QoQ to $3.26 billion, representing an 8.1% market share.

SMIC’s revenue increased 1.7% QoQ to $2.2 billion, securing 5.5% market share and the third position.

UMC saw a 0.3% QoQ revenue drop to $1.87 billion, for fourth posirion.

GlobalFoundries hadc5.2% QoQ revenue growth to $1.83 billion.

HuaHong Group ranked sixth, with Q4 revenue increasing 6.1% QoQ to $1.04 billion.

HHGrace’s 12-inch fabs saw slight capacity utilization improvements, boosting wafer shipments and ASPs.

HLMC benefited from China’s home appliance subsidy program and inventory replenishment which increased utilisation rates.

Tower Semiconductor maintained its seventh-place ranking, with 4.5% QoQ revenue growth to $387 million.

VIS ranked eight after a 2.3% QoQ revenue decline to $357 million.

Nexchip moved up to ninth place with 3.7% QoQ revenue growth to $344 million.

PSMC fell to tenth place, impacted by weaker demand for memory foundry and consumer-related chips.

Electronics Weekly

Electronics Weekly