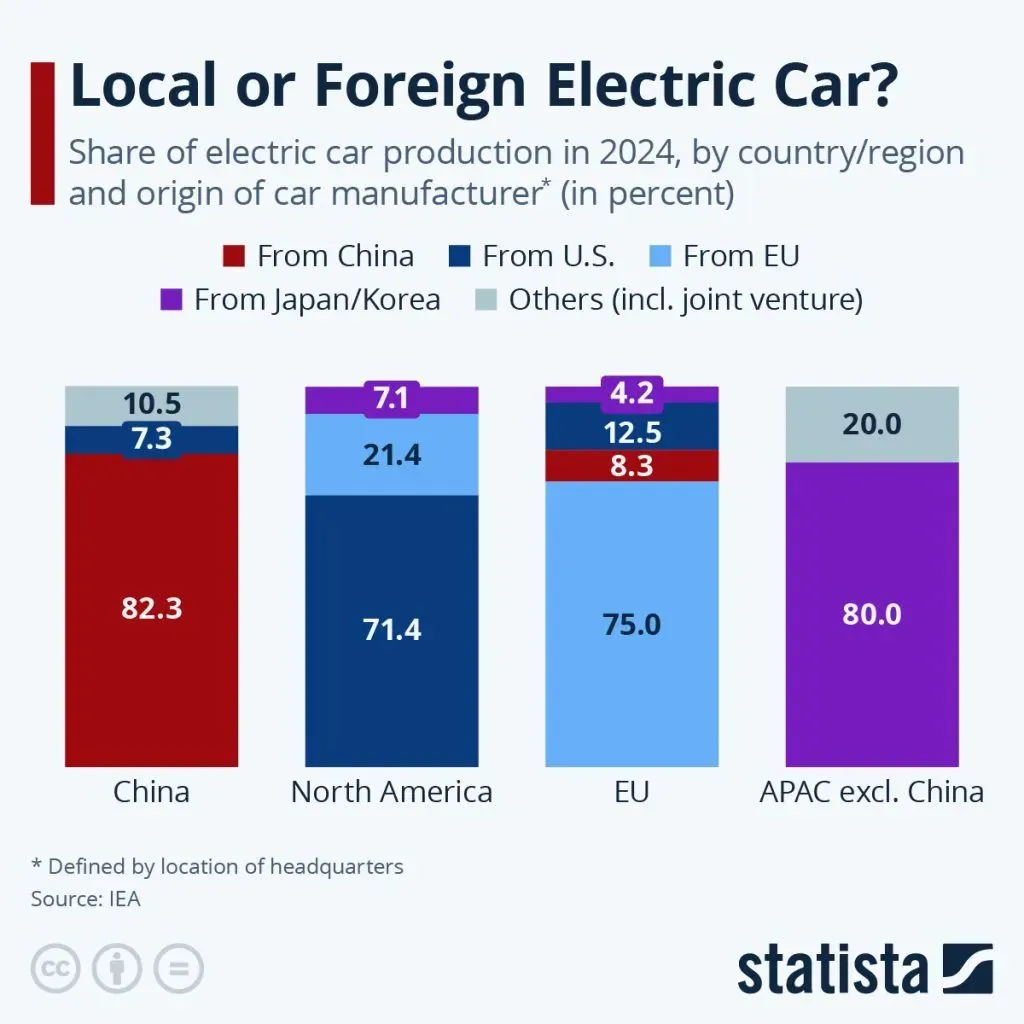

In general, most EVs produced in China, North America, the European Union and the APAC region are manufactured by companies from those countries or regions.

The picture is starting to look more mixed in North America and the EU, however. Carmakers headquarters in the EU dominate non-U.S. production in North America ahead of Japan and Korea, while in the EU, U.S.-based companies hold a smaller share of EV production as Chinese, Japanese and Korean companies also compete with their locally produced cars.

China is seeing a small share of cars produced by U.S. companies (Tesla is running two factories near Shanghai), while otherwise focusing on joint ventures with foreign car makers.

The IEA reports that U.S. companies Tesla and Ford ramped up their EU-based production in 2024, while some European companies saw their domestic production contract or stagnate.

On the other hand, the production of EVs in the U.S. also fell by 7 percent, while production in Mexico – mainly by U.S. companies – grew.

While China, Japan, Korea and the EU were exporting some of their EV production, the U.S. and the rest of the world supplemented their local production with a significant number of imported EVs

Electronics Weekly

Electronics Weekly

No surprises then. When it comes to trade geography is important.